kansas sales tax exemption certificate

At least 11 states - including. Drop shipped to a Kansas location the out-of-state retailer must provide to the third party vendor a Kansas sales tax registration number either on this certificate or the Multi-Jurisdiction.

How To Get A Resale Exemption Certificate In Kansas Startingyourbusiness Com

Ad 1 Fill out a simple application.

. Ad New State Sales Tax Registration. In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Presents to a retailer to claim exemption from Kansas sales or use tax.

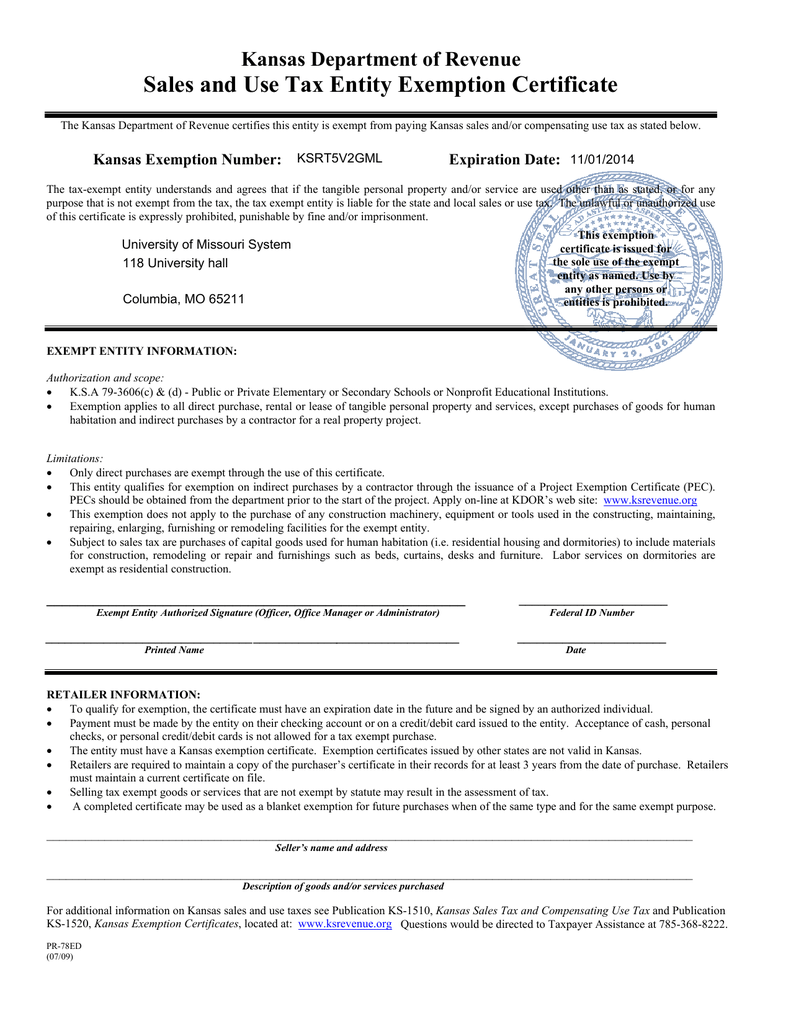

Sales and Use Tax Entity Exemption Certificate. Sales tax exemption certificates may also be used to claim exemption from compensating use tax. This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA.

How to use sales tax exemption certificates in Kansas. All construction materials and prescription drugs including prosthetics and. A Kansas resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to.

This use tax applies to purchases of goods from businesses in other states and its. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from. Street RR or P.

You can download a PDF of. Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms. It shows why sales tax was not charged on a retail sale of goods or taxable services.

Step 1 Begin by downloading the Kansas Resale Exemption Certificate Form ST-28A. Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor.

Step 2 Identify the sellers name business address Sales Tax Registration Number and a general. Ad Download or Email MTC Sales Tax Cert More Fillable Forms Register and Subscribe Now. 79-3606fff exempts all sales of material handling equipment racking systems and other related machinery and equipment used for the handling movement or storage of tangible.

Ad Download or Email MTC Sales Tax Cert More Fillable Forms Register and Subscribe Now. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. Your Kansas Tax Registration Number.

2 Get a resale certificate fast. Sales and Use Tax Entity Exemption Certificate The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

Kansas Department of Revenue. In a word yes tax exemption certificates expire - though the more complicated explanation is that it depends on your state and entity type. 2 Get a resale certificate fast.

1320 Research Park Drive Manhattan Kansas 66502 785 564-6700 The information contained in this handbook is for informational purposes only and is to be used as a resource. Box City State Zip 4. The undersigned purchaser certifies that the tangible personal property or services purchased from.

The buyer furnishes the. Kansas Sales Tax Exemption Certificate information registration support. Ad 1 Fill out a simple application.

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Sales And Use Tax Entity Exemption Certificate Kansas Department Of Revenue

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Kansas Resale Exemption Certificate Fill Online Printable Fillable Blank Pdffiller