how much of my paycheck goes to taxes in colorado

And if youre in the construction. The final 25000 of your income would be taxed at 30 or 7500.

Colorado Salary Calculator 2022 Icalculator

72973 per year.

. Updated for 2022 tax year. Colorado Salary Paycheck Calculator. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Every employer who is required to withhold Colorado income tax must apply for and maintain an active Colorado wage withholding account. Calculate your take home pay after federalstatelocal taxes deductions and exemptions.

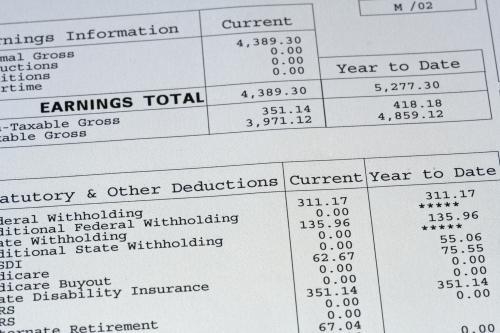

Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. The result is that the FICA taxes you pay are. Youll receive your Colorado Cash Back check in the mail soon.

If you make 100000 a year living in the region of Colorado USA you will be taxed 27027. 2000 6000 7500 15500. Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

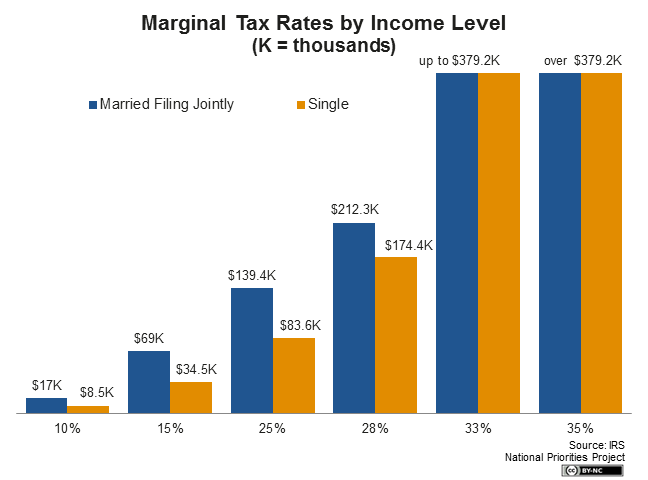

You pay the tax on only the first 147000 of your. You are able to use our Colorado State Tax Calculator to calculate your total tax costs in the tax year 202223. These tiers are if you file taxes as a single individual.

You make 15 an hour and you worked 80 hours over the past two weeks. Its your first payday at a new job. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

What percentage of tax is taken out of my paycheck in Colorado. The next 30000 would be taxed at 20 or 6000. If your monthly paycheck.

If youve already filed your Colorado state income tax return youre all set. How Much Of Your Paycheck Goes To Taxes And Why. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator.

Simply enter their federal and state W-4 information as. No state-level payroll tax. Just enter the wages tax withholdings and other information required.

For annual and hourly wages. It changes on a yearly basis and is dependent on many things including wage and industry. Our calculator has recently been updated to include both the latest Federal Tax.

Colorado Cash Back. The first 20000 of that would be taxed at 10 or 2000. Employers may apply for an account online at.

That means that your net pay will be 72973 per year or 6081 per. Colorado Unemployment Insurance is complex. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Colorado Hourly Paycheck Calculator.

Colorado Proposition 116 Decrease Income Tax Rate From 4 63 To 4 55 Initiative 2020 Ballotpedia

Income Definition Exceptions Colorado Family Law Guide

Alabama Salary Paycheck Calculator Gusto

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

States With The Highest Lowest Tax Rates

2022 State Tax Reform State Tax Relief Rebate Checks

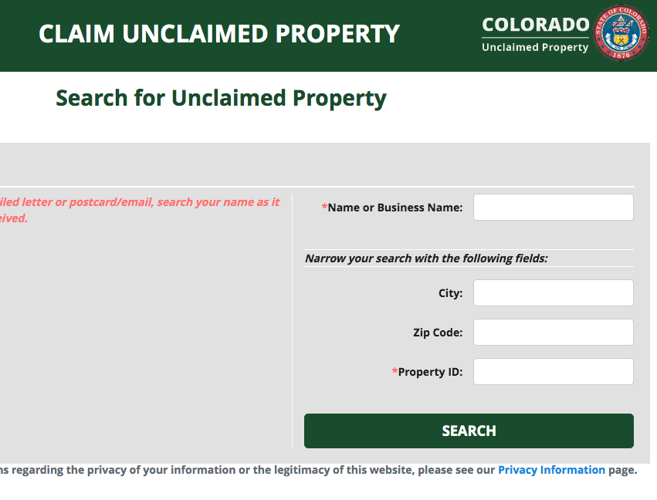

Great Colorado Payback Asks You To Claim Property Local News Stories Montrosepress Com

Colorado Proposition 116 Decrease Income Tax Rate From 4 63 To 4 55 Initiative 2020 Ballotpedia

State Income Taxes Highest Lowest Where They Aren T Collected

![]()

Colorado Nanny Tax Rules Poppins Payroll Poppins Payroll

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Taxes In Boulder The State Of Colorado

Income Tax Topic Part Year Residents Nonresidents Department Of Revenue Taxation

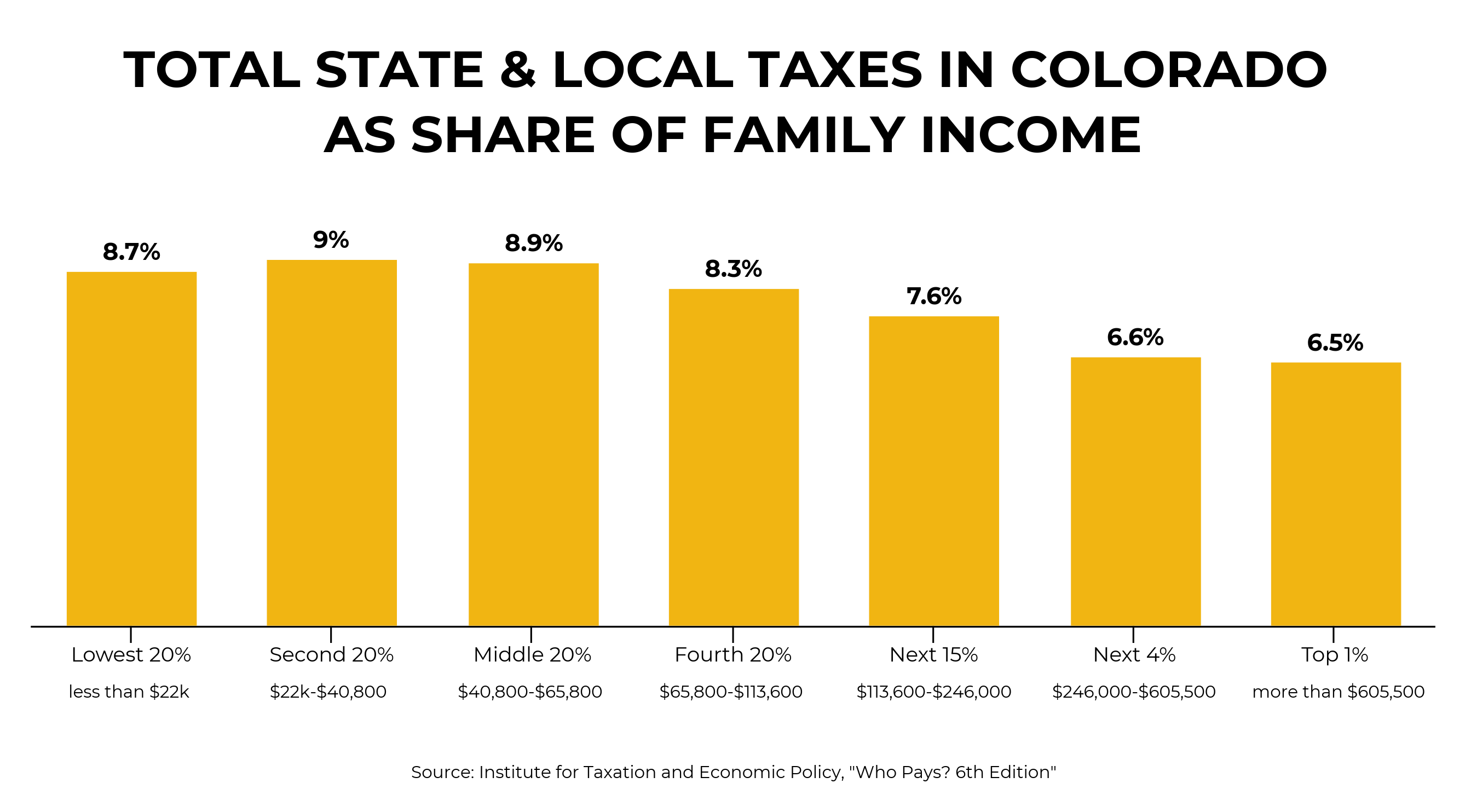

Learn More Quick Facts On A Fair Tax For Colorado

Irs Announces Tax Inflation Adjustments Why Your Paycheck Could See A Bump Fox21 News Colorado

Percent Of Your Income Is Going To Taxes

Colorado Businesses That Owed State Taxes Got Ppp Loans 9news Com